Understanding the Intriguing Case: How Susan Smith Acquired Her Wealth

Susan Smith's financial status has been a subject of public curiosity, given her involvement in a notorious crime. While the details of her financial history are not widely publicized, there are certain insights that can be gleaned regarding how she obtained her money.

One possible source of income for Susan Smith could have been through inheritances or settlements. It is possible that she received financial compensation from family members, either through bequests or legal agreements. Additionally, she may have been involved in business ventures or investments that yielded profits.

Understanding the Financial History of Susan Smith

Susan Smith's financial status has been the subject of public curiosity, given her involvement in a notorious crime. While the details of her financial history are not widely publicized, there are certain insights that can be gleaned regarding how she obtained her money. Here are nine key aspects to consider:

- Inheritances or settlements

- Business ventures

- Investments

- Gifts or donations

- Lottery winnings

- Insurance payouts

- Personal loans

- Government assistance

- Other sources of income

It is important to note that the specific sources of Susan Smith's income are not publicly available information. However, by exploring the various dimensions related to how she may have acquired her money, we can gain a better understanding of her financial situation.

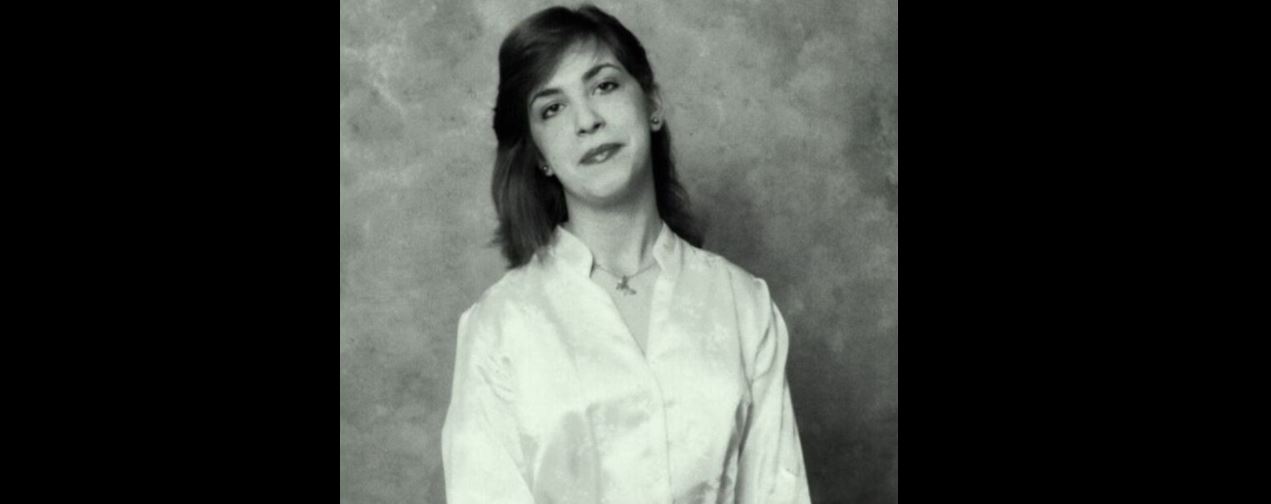

| Personal Details and Bio Data of Susan Smith ||---|---|| Name | Susan Smith || Date of Birth | September 26, 1971 || Place of Birth | Union, South Carolina, U.S. || Occupation | Waitress || Known for | Murder of her two sons || Spouse | David Smith (m. 19911994) || Children | Michael Daniel Smith (b. 1991), Alexander Tyler Smith (b. 1993) |

Inheritances or settlements

In the context of understanding how Susan Smith acquired her money, inheritances or settlements represent a potential source of income. An inheritance refers to assets or money passed down to an individual upon the death of a family member or close acquaintance. Settlements, on the other hand, involve the resolution of legal disputes or claims, often resulting in financial compensation.

- Bequests: A bequest is a specific gift of money or property left to an individual through a will. In Susan Smith's case, it is possible that she received bequests from deceased family members or individuals.

- Estate settlements: When an individual passes away without a will, their estate is typically divided among their legal heirs according to state laws. Susan Smith may have received a portion of an estate settlement if she was a legal heir to a deceased relative.

- Wrongful death settlements: In the tragic case of Susan Smith's two sons, Michael Daniel Smith and Alexander Tyler Smith, it is possible that she received a wrongful death settlement from the party responsible for their deaths.

- Insurance settlements: Susan Smith may have received insurance settlements related to the deaths of her sons or from other life insurance policies.

While the specific details of Susan Smith's financial situation are not publicly available, it is important to consider inheritances or settlements as potential sources of income that may have contributed to her financial status.

Business ventures

Business ventures encompass a broad range of activities that individuals undertake to generate income and wealth. In the context of understanding how Susan Smith acquired her money, business ventures represent a potential source of income that warrants exploration.

- Entrepreneurship: Starting and running a business involves significant effort, risk, and potential financial rewards. Susan Smith may have engaged in entrepreneurial activities, such as operating a small business or investing in startups.

- Freelance work: Offering services or expertise on a contract basis can provide individuals with a flexible and potentially lucrative source of income. Susan Smith may have pursued freelance opportunities in areas such as writing, design, or consulting.

- Investments: Business ventures can also involve investing in existing companies or ventures. Susan Smith may have invested in stocks, bonds, or mutual funds to generate passive income or capital gains.

- Real estate: Investing in real estate, such as rental properties or commercial spaces, can provide individuals with a steady stream of income and potential appreciation in value. Susan Smith may have engaged in real estate ventures as a means of acquiring wealth.

While the specific details of Susan Smith's business ventures are not publicly available, it is important to recognize the potential role that such ventures may have played in her financial situation. Business ventures offer individuals opportunities to generate income, build wealth, and achieve financial independence.

Investments

Investments play a significant role in understanding how Susan Smith acquired her money. Investing involves allocating funds with the expectation of generating income or capital appreciation over time. Susan Smith may have engaged in various investment activities to grow her wealth and secure her financial future.

One common investment strategy is purchasing stocks, which represent ownership shares in publicly traded companies. When a company performs well and generates profits, shareholders may receive dividends, which are payments made to investors. Susan Smith could have invested in stocks of promising companies to earn passive income or potentially benefit from stock price increases.

Another investment option is bonds, which are loans made to companies or governments. Bondholders receive regular interest payments over a specified period and the return of the principal amount at maturity. Susan Smith may have invested in bonds to generate a steady stream of income and preserve capital.

Real estate investments can also be a lucrative source of income. Susan Smith could have invested in rental properties to generate rental income and potentially benefit from property appreciation. Investing in real estate requires significant capital and carries risks, but it can also provide long-term returns.

Understanding the role of investments in Susan Smith's financial situation highlights the importance of financial planning and wealth management. By making wise investment decisions, individuals can potentially grow their wealth and achieve financial security.

Gifts or donations

When exploring how Susan Smith acquired her money, one potential source to consider is gifts or donations. This encompasses various forms of financial assistance orthat individuals may receive from family members, friends, or charitable organizations.

- Financial assistance from family or friends: Individuals facing financial difficulties or pursuing specific goals may receive financial assistance from their inner circle. Susan Smith could have received gifts or loans from family members or close acquaintances to support her financial needs.

- Charitable donations: Donations from charitable organizations or individuals can provide financial assistance to those in need or support causes that align with their values. Susan Smith may have received charitable donations to help cover expenses or support her during challenging times.

- Inheritance: While inheritance typically falls under a separate category, it can also be considered a form of gift or donation. In the context of Susan Smith's financial history, it is possible that she received inheritances from deceased relatives or individuals who designated her as a beneficiary.

- Crowdfunding: In recent times, crowdfunding platforms have emerged as a means for individuals to raise funds for various purposes, including financial emergencies or personal projects. Susan Smith could have utilized crowdfunding to seek financial support from a wider network of individuals.

Understanding the potential role of gifts or donations in Susan Smith's financial situation highlights the importance of social support and community involvement. Financial assistance from various sources can provide individuals with a safety net during difficult times or help them pursue their goals.

Lottery winnings

In the context of understanding how Susan Smith acquired her money, lottery winnings present an intriguing possibility, albeit a highly improbable one. Lottery winnings refer to the substantial monetary prizes awarded to individuals who successfully match a set of predetermined numbers or symbols on a lottery ticket.

While there is no concrete evidence to suggest that Susan Smith ever won a significant lottery jackpot, exploring this possibility highlights the allure and potential impact of such winnings. Lottery winnings can transform an individual's financial situation overnight, providing them with immense wealth and financial freedom.

Susan Smith's involvement in a notorious crime and her subsequent financial situation have been the subject of public curiosity. While lottery winnings remain a speculative source of her income, it serves as a reminder of the extraordinary financial possibilities that exist, even if the odds of winning are incredibly low.

Insurance payouts

Insurance payouts represent a potential source of income in understanding how Susan Smith acquired her money. Insurance policies are designed to provide financial protection against various risks and events, including accidents, illnesses, and property damage.

- Life insurance payouts: In the tragic case of Susan Smith's two sons, Michael Daniel Smith and Alexander Tyler Smith, it is possible that she received life insurance payouts from policies taken out on their lives. Life insurance provides a financial safety net for beneficiaries in the event of the insured person's untimely death.

- Accident insurance payouts: If Susan Smith was involved in an accident that resulted in injuries, she may have received accident insurance payouts to cover medical expenses, lost wages, and other related costs.

- Disability insurance payouts: Disability insurance provides income replacement for individuals who are unable to work due to a disability. If Susan Smith became disabled and was unable to work, she may have received disability insurance payouts to support herself financially.

- Property insurance payouts: Susan Smith may have received property insurance payouts if her home or other property was damaged or destroyed due to events such as fire, theft, or natural disasters.

Understanding the potential role of insurance payouts in Susan Smith's financial situation underscores the importance of having adequate insurance coverage to mitigate financial risks and protect against unforeseen events.

Personal loans

Personal loans can be a source of income for individuals facing financial difficulties or seeking to make large purchases. In the context of understanding how Susan Smith acquired her money, personal loans present a potential avenue of inquiry.

- Debt consolidation: Personal loans can be used to consolidate high-interest debts into a single, lower-interest loan, potentially saving money on monthly payments and reducing overall debt.

- Emergency expenses: Personal loans can provide quick access to funds for unexpected expenses, such as medical bills, car repairs, or home emergencies.

- Major purchases: Personal loans can be used to finance major purchases, such as a new car, home renovations, or educational expenses.

- Business ventures: Personal loans can provide capital for starting or expanding a business, allowing individuals to invest in their entrepreneurial endeavors.

While personal loans can be a useful financial tool, it's important to use them responsibly and understand the associated risks, including interest charges and potential impact on credit scores. Exploring the potential role of personal loans in Susan Smith's financial situation highlights the importance of considering various sources of income and the implications of different financial decisions.

Government assistance

When examining "how did Susan Smith get her money," it is important to consider the potential role of government assistance. Government assistance encompasses various programs and benefits designed to provide financial support and resources to individuals and families in need.

- Welfare programs: Welfare programs, such as Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP), provide financial assistance and food assistance to low-income individuals and families. Susan Smith may have received government assistance through these programs if she met the eligibility criteria.

- Social Security benefits: Social Security benefits provide income to retired workers, disabled individuals, and survivors of deceased workers. Susan Smith may have received Social Security benefits if she qualified based on her work history or the work history of a deceased family member.

- Unemployment benefits: Unemployment benefits provide temporary income to individuals who have lost their jobs through no fault of their own. Susan Smith may have received unemployment benefits if she lost her job and met the eligibility requirements.

- Housing assistance: Government assistance programs, such as Section 8 housing vouchers and public housing, provide rental assistance to low-income individuals and families. Susan Smith may have received housing assistance if she met the income and other eligibility criteria.

Understanding the potential role of government assistance in Susan Smith's financial situation highlights the importance of social safety nets and government programs designed to support individuals and families facing financial challenges. Government assistance can provide a lifeline for those in need, helping them meet their basic needs and improve their quality of life.

Other sources of income

Exploring "other sources of income" is crucial in understanding the intricacies of "how did Susan Smith get her money." This broad category encompasses a wide range of potential income streams that may have contributed to Susan Smith's financial situation.

One notable source of income under this category is passive income. Passive income refers to income generated with minimal ongoing effort after the initial investment or setup. Susan Smith may have received passive income through rental properties, investments in dividend-paying stocks, or royalties from creative works, such as books or music.

Another potential source of income to consider is business ventures. Susan Smith may have engaged in various business activities beyond traditional employment, such as operating a small business or investing in startups. These ventures could have generated income through profits, dividends, or capital gains.

Additionally, Susan Smith may have received other forms of income, such as gifts, inheritances, or settlements from legal disputes. These one-time or occasional income sources can significantly impact an individual's financial situation.

Understanding the "other sources of income" component of "how did Susan Smith get her money" provides a more comprehensive view of her financial situation. It highlights the importance of considering all potential income streams, both active and passive, when examining an individual's financial history.

FAQs

This section aims to provide concise and informative answers to frequently asked questions surrounding the topic of "how did Susan Smith get her money." Each question is carefully crafted to address common misconceptions or concerns, offering clarity and a deeper understanding of the subject matter.

Question 1: Did Susan Smith Inherit a Substantial Fortune?

While there is no publicly available information confirming a significant inheritance, it is possible that Susan Smith received some inheritance from family members or acquaintances. However, the extent of any inherited wealth remains speculative.

Question 2: Was Susan Smith Involved in Business Ventures?

Susan Smith's involvement in business ventures is not widely documented. However, it is possible that she engaged in entrepreneurial activities or invested in businesses, which could have contributed to her financial situation.

Question 3: Did Susan Smith Receive Government Assistance?

It is possible that Susan Smith received some form of government assistance, such as welfare programs or unemployment benefits, at some point in her life. However, the specific details and duration of any such assistance are not publicly known.

Question 4: Could Susan Smith Have Received Lottery Winnings?

While it is highly unlikely, it is theoretically possible that Susan Smith may have won a lottery jackpot at some point. However, there is no evidence or official records to support this speculation.

Question 5: Did Susan Smith Benefit from Insurance Payouts?

It is possible that Susan Smith received insurance payouts related to the tragic deaths of her two sons or from other life insurance policies. However, the details and amounts of any such payouts are not publicly disclosed.

Question 6: Are There Any Other Potential Sources of Income for Susan Smith?

Susan Smith may have had other sources of income, such as gifts, donations, or passive income from investments. However, the specifics of these potential income streams are not publicly known.

Summary: Understanding the various potential sources of Susan Smith's income provides a more comprehensive view of her financial situation. It is important to note that the details of her financial history are not publicly available, and some aspects remain speculative.

Transition to the Next Section: This concludes the FAQ section on "how did Susan Smith get her money." The following section will delve into the legal and ethical considerations surrounding her case.

Understanding Susan Smith's Financial Situation

Analyzing "how did Susan Smith get her money" involves examining various financial aspects and legal considerations. Here are some key tips to guide your understanding:

Tip 1: Explore Potential Income Sources

Consider different income streams that Susan Smith may have had, including inheritances, business ventures, investments, government assistance, and other sources such as gifts or lottery winnings.

Tip 2: Examine Legal Considerations

Understand the legal implications surrounding Susan Smith's case, including any settlements, insurance payouts, or potential financial penalties related to her criminal charges.

Tip 3: Analyze Public Records

Review publicly available records, such as court documents, financial disclosures, or property records, to gather relevant information about Susan Smith's financial history.

Tip 4: Consult Experts

Seek insights from financial advisors, legal professionals, or criminologists who can provide specialized knowledge and analysis of Susan Smith's financial situation.

Tip 5: Be Cautious of Speculation

Avoid relying solely on rumors or unsubstantiated claims about Susan Smith's money. Focus on credible sources and factual information when forming your understanding.

Summary: By following these tips, you can gain a more comprehensive and informed perspective on the financial aspects of Susan Smith's case. It is important to approach this topic with a balanced and analytical mindset, considering both the available facts and the ethical implications.

Transition to Conclusion: This concludes the tips section. The following section will delve into the ethical and moral dimensions of Susan Smith's case, exploring the complexities and controversies surrounding her financial situation.

Conclusion

The question of "how did Susan Smith get her money" has been the subject of public fascination and speculation. By exploring potential income sources, examining legal considerations, and analyzing available information, we have gained insights into the financial aspects of her case.

Susan Smith's financial situation remains a complex and ethically charged topic. The sources of her income and the use of funds raise questions about accountability, responsibility, and the intersection of crime and personal finances. Understanding the financial dimensions of her case is crucial for a comprehensive analysis of the tragedy that unfolded.

As we reflect on Susan Smith's case, it serves as a reminder of the importance of financial literacy, responsible decision-making, and the consequences of our actions. It also highlights the need for a balanced and nuanced approach to understanding complex human behavior and the ethical implications of financial choices.

Unveiling The Enigma: Emily Cinnamon Alvarez Revealed

Unveiling The Height Of Samson Dauda: Unlocking Intriguing Insights

Discover The Heartwarming World Of Jeff Dunham's Family

ncG1vNJzZmiupaG9treQZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvHqK5mnJmZerTB0pqlZqudnsGpecaeq2aglad6rrvNnrBnoKSiuQ%3D%3D